In the insurance industry, the customer service experience is on the decline. More and more customers turn to digital channels to select a policy and get their questions answered. But when it comes to digitalisation, insurance companies have some catching up to do.

The good news is that there are solutions and strategies to hand to develop your digital offering and boost customer satisfaction. Let’s find out how it’s done!

The Current State Of Customer Satisfaction

[ca-form id=”194451″ align=”left” var1=”https://www.customer-alliance.com/wp-content/uploads/2022/08/customer-alliance-article-guide-customer-experience-insurance-EN-download.pdf”]

In order to improve, first you must know where things currently stand. Research shows that less than 30% of global insurance customers report positive customer experiences (1). Why is this? There are a couple of different factors to consider.

The COVID-Catalyst: Increasing The Expectation Gap

The pandemic forced customers to make more of their purchases online. As a result, even the most unlikely demographics are increasingly comfortable buying services and products virtually. The ease and convenience linked to digital experiences have had a knock-on effect.

Now, consumers have higher expectations than ever. So with lots of online competition out there in the insurance industry, customers are more likely to reconsider their options. As they become savvier, consumers will naturally be drawn to insurers with the best digital offerings.

In fact, a study by PwC found that 41% of insurance customers are likely or more likely to switch providers due to a lack of digital capabilities (2).

Millennials: High Standards For The Customer Service Experience

More than 20% of the world’s population are millennials (3). That’s a significant share of your customers! Born between 1981 and 1996, this generation is digital natives and the first to grow up with technologies like the Internet, social media and mobile phones.

So it comes as no surprise that this demographic wants convenient, digital solutions that they can access on the go. Not only that, but they are quick to voice their opinions if the customer experience is not up to scratch.

Combine these two factors together, and it’s clear to see why customer satisfaction is suffering across the insurance industry.

Improving The Customer Service Experience: What’s The Solution?

Now we know the problem. So how do we fix it? It’s clear that embracing digitalisation is key to future success in the insurance industry. The focus needs to be on creating seamless digital customer experiences – and fast!

Using Voice Of The Customer To Improve The Customer Service Experience

At the moment, 60% of insurers say that their company lacks a customer experience strategy (4). This approach is all about planning how to provide positive experiences to your customers across their entire customer journey (and measuring the experience in a purposeful way). The end result is boosted customer satisfaction and an improved customer service experience.

A Voice of the Customer platform is an ideal way to kick-start your efforts, better understand your customers and generate powerful results. Let’s take a closer look at what this entails.

Map Your Customer Journey

A customer journey map is all about plotting out the route a customer takes when engaging with your business. The map can include everything from seeing a company advert online all the way through to leaving a review for your service. By going through your customer journey step-by-step, it becomes easier to see areas where the customer service experience may be suffering. In the insurance industry, some pitfalls might be:

- Having to provide the same information multiple times (either when getting a quote or filing a claim)

- Being unable to find an answer to a basic question online

- Too much insurance jargon that’s hard to understand

- Having to switch from one channel to another (e.g. from live chat to telephone)

Sometimes, a simple change to your process can make a huge difference to customer satisfaction. To read about customer journey mapping in more detail, head over to our article: How a Customer Journey Map Helps you Offer Unique Experiences

Respond To Reviews

No matter what, you’re always going to have some unhappy customers. While some will simply look for an insurance policy elsewhere, others will share their opinions. Some will choose to do so on a public review platform.

The way you respond to these reviews can have a huge impact on your business. Why? Writing genuine, personalised replies to reviews is one way of showing your customers that you care. This goes a long way in building the trust you need in the insurance industry.

Responding to reviews, both positive and negative, has lots of benefits for your business and online reputation. It can:

- Increase the number of reviews you receive, giving you even more valuable feedback to work with

- Prevent future negative reviews when people can see previous solutions for complaints like their own

- Stop you from losing a customer by solving their issue (that you might not otherwise have known about)

- Change a potential customer’s opinion of your insurance company

- Help build relationships and show support to your existing customers

Capture Customer Feedback

[ca-form id=”44600″ align=”right”]

Asking your current customers for their opinions is great for figuring out where you stand. The easiest and most convenient way to do this? With a digital survey! When designed properly, surveys are an effective tool that will get you hyper-relevant information about your customers’ needs and expectations.

If you’re focussing on digital channels, then in-web and in-app surveys are ideal. These short one or two-question surveys appear right on the users’ screen, capturing feedback at the perfect time. The mobile-friendly aspect of surveys is particularly important for the younger insurance demographic. In fact, financial institutions report that 58% of customers aged 17-24 complete their surveys on a mobile device (5).

By asking targeted questions and using customer satisfaction metrics, you can quickly gather a wealth of information that you can use to improve. Not only will you better understand satisfaction drivers, but you will also open up communication that will improve your customer relationships.

Measure Customer Satisfaction

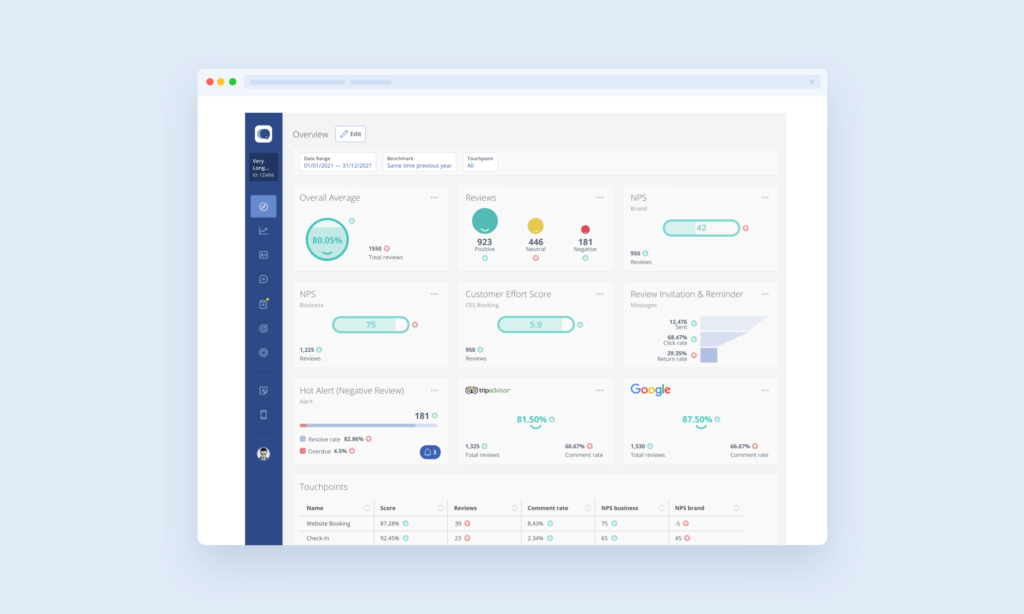

Giving tangible scores to customer satisfaction is a great way to keep on top of it. But how do you measure customer happiness? The answer is customer satisfaction metrics.

There are a few different metrics out there that can improve the customer service experience, but these are the most common:

- Net Promoter Score (NPS) – this measures customer loyalty by asking the likelihood of customers recommending you to a friend, colleague or family member

- Customer Effort Score (CES) – as the name suggests, this metric determines how much effort a customer has to put into a specific interaction with your brand (think setting up an account or contacting customer service)

- Customer Satisfaction Score (CSAT) – this measures satisfaction at specific points in your customer journey by asking customers to rate their satisfaction on a scale of 1-5

These types of questions can be easily incorporated into customer surveys to give you scores to monitor and improve. For a more in-depth look into customer satisfaction metrics, be sure to check out our article: How to measure customer satisfaction KPI: NPS, CSAT, CES, & CLI

Analyse Your Results

When handling large amounts of data, it’s important that you can easily extract the information you need. Are there certain words or topics that come up more than others? Do certain departments consistently perform worse or better than others? Are particular parts of your process hurting the customer service experience? These are all the kinds of questions you need to be able to answer.

Where generating feedback gives you an idea of how happy your customers are, analysis helps you understand why. When you know what drives satisfaction, you can prioritise those areas and improve your service. Similarly, when you know what drives dissatisfaction for your clients, you are better primed to take action. Rather than guessing at ways to improve, you can use real data to inform your decisions and achieve much better results.

This all sounds a little time-consuming, right? Well, a good Voice of the Customer platform will instantly analyse your survey results for you. By giving you valuable insights in an easy, accessible way, this kind of software will help you save time and have a greater impact on your company.

Take Action To Improve

During research into customer satisfaction in the insurance industry, McKinsey came across one business that had upgraded their telephone service in order to reduce waiting times and improve customer satisfaction. They managed to reduce waiting times from 40 seconds to 20 seconds, at a significant cost. However, their hypothesis proved incorrect. Despite the shorter wait on the line, customer satisfaction showed no improvements.

What’s the lesson here? To avoid wasted time and money (and to get the best results) you need data to back up your decisions. The strategies we’ve discussed in this article will give you a complete picture of what your customers want. Armed with this knowledge, you can feel confident you are making improvements that will bring you closer to your business goals.

Conclusion: Improving The Customer Service Experience In The Insurance Industry

Delivering outstanding customer satisfaction in the insurance industry is about more than introducing a mobile app or adding live chat to your site. For the kind of seamless experience that creates happy customers, you need to really listen to what they want. Implementing a Voice of the Customer program is the perfect way to gather all the information you need and improve customer satisfaction along the way.

Sources

- World Insurance Report, Capgemini

- COVID-19 Consumer Insurance and Retirement Pulse Survey, PwC

- ‘There are 1.8 billion millennials on earth. Here’s where they live’, World Economic Forum

- Elevating the insurance customer experience, IBM

- CX Compass survey, ResponseTek