Customer satisfaction automotive scores don’t lie.

Volvo tied for 1st place in the 2018 American Customer Satisfaction Index, with a customer satisfaction score of 85 (up from the previous year’s score of 82).

You know what else happened that year?

Volvo had a whopping 27.6% increase in the numbers of vehicles sold (1).

Moral of the story: Focusing on a customer satisfaction automotive strategy brings major results.

Reminder: Customer satisfaction matters in the automotive industry

Since 2015, customer satisfaction and loyalty have dropped across almost all service providers.

In fact, according to the 2020 American Satisfaction Index (ACSI), customer satisfaction scores have been the lowest since 1999. Just look at the following scores in the automotive customer satisfaction index:

- 79 in Europe

- 78 in Japan/Korea

- 76 in the U.S.

Automobile customer satisfaction regarding the customer experience is now a huge (if not THE) point of differentiation among franchise dealers. In fact, 54% of customers would purchase a car from a dealership that offers their preferred service, even if the dealership didn’t have the lowest price (2).

First, automotive companies must understand why customer satisfaction is important. Then to increase customer satisfaction and loyalty, automotive companies must learn what their customers’ expectations are.

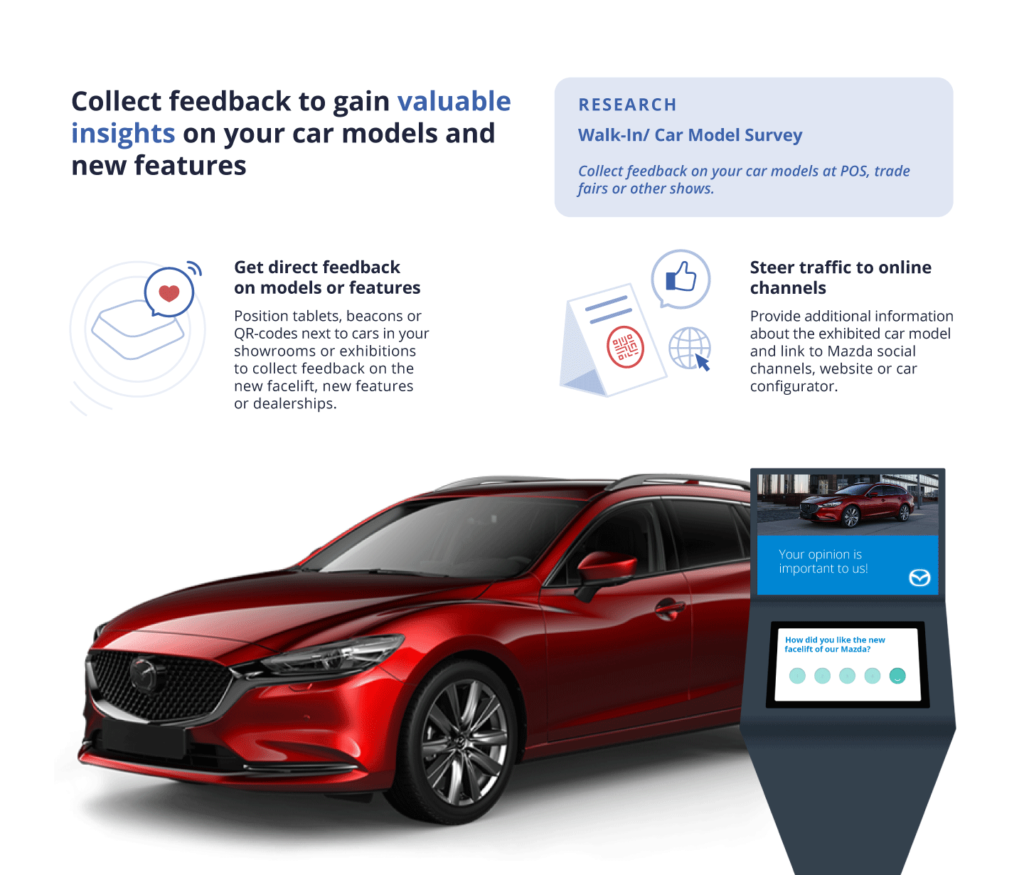

For a real-life example, see how Mazda Motor Europe increased customer satisfaction scores last year despite the industry average going down. Get the Mazda Motor Europe case study.

3 ways car companies can improve customer satisfaction

Despite being one of the first industries to invest in customer satisfaction, the automotive industry has fallen behind in leading in it. (That is to say, if the latest automobile customer satisfaction ratings tell us anything.)

To regain leadership in this area, automotive companies need to revisit their customer satisfaction strategies and consider the following:

Digitalise your automotive customer journey

Yes, many automotive customers still like to shop at the dealership, but that’s not where the customer journey starts.

Automotive buyers can encounter up to 900 touchpoints before making their car purchase according to Think with Google research (3). So many of these digital touchpoints occur during the initial research stage of the automotive customer journey (i.e. before they ever step foot on a dealership). But they also continue even after a dealership visit. Don’t miss out on these potential touchpoints.

Things to consider regarding automotive digital touchpoints:

- Which social media channel(s) is best to focus on for our target audience?

- Is our website complete with a live store, a virtual saleroom, and live chat with brand experts?

- Do we offer easy test drive booking and service appointments from the website?

- Are there links to showrooms and/or pop-up stores on our website?

- Is our website mobile-friendly?

While most prospective buyers will want to test drive the car in person, you can still close the deal virtually. For example, consider co-browsing and virtual meeting options complimented by paperless transactions and digital signature solutions.

Perhaps digitalising your automotive customer journey seems like a lot of work. But trust us, this investment will not only attract more customers, it will also be the golden standard a few years from now.

[ca-form id=”44600″ align=”right”]

Be strategic with your customer satisfaction questionnaire

It’s true. If you’re in the car dealership business, you’re well aware of the importance of measuring your customer satisfaction KPI. But are you sure that your automobile customer satisfaction survey is as effective as it can be? Go beyond customer satisfaction factors and consider how you present your survey.

Ask at the right time

If you begin tracking potential customers from the research stage of the customer journey, you’ll gather enough data to know when it’s best to send them a survey about a particular aspect of their journey.

Is it best to ask them in-store, while they wait at service, an hour or a week after they visit? Experiment and monitor results to learn when is the best time to send each survey.

Ask on the right channel

Even how you ask for feedback will affect the survey response rate. Utilise customer segmentation and explore which channels work best for getting survey responses for each segment.

Is it email, text messages, WiFi start page, in-store tablets, embedded in chat or website, or QR code?

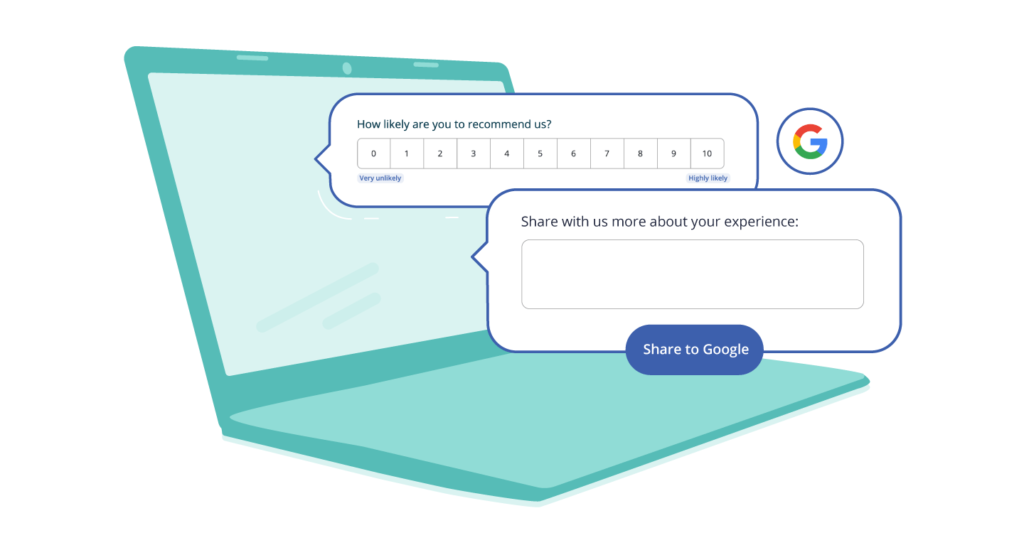

Ask to share

Customers make the best brand ambassadors. The easiest way to boost your online presence? Ask customers to share their reviews to major review sites and Google.

Don’t worry, there are SaaS programs that let you add a button to your surveys so customers simply click to publicly share their review to a review portal. (P.s. we have a leading automotive customer satisfaction platform.)

There’s a lot to be done within the customer satisfaction survey automobile industry. Lead the change and prove that your company’s a forerunner in caring about your customers’ opinions.

Leverage your customer satisfaction survey results

We always recommend companies analyse, optimise, and share customer feedback for maximum impact.

Analyse your customer satisfaction automotive scores

Only after you know what customers want can you satisfy them. Don’t guess.

Ensure your company has powerful analytical tools to dive into the semantic meaning of customers’ feedback. Track keywords and discover trending topics that matter to customers.

Learn what customers’ true expectations are to get ahead of the competition.

Optimise your customer satisfaction methods

It’s important to follow how your customer satisfaction metrics like your net promoter score calculation differ across your company. Oversee variations in your among locations and sectors, such as sales, service, and support. Ask, is this location meeting, failing or exceeding our net promoter score benchmark, and why or why not?

Then, pick up on best practices from the locations and sectors doing well and optimise accordingly. For more details, check out Customer Satisfaction KPI and why you need to focus on one or two.

Share your automobile customer satisfaction ratings

Don’t forget to take care of your online reviews. As mentioned earlier, they matter big time to your online reputation! So, don’t only ask customers to publish their reviews online, make sure you also take care of negative reviews efficiently.

Did you know that 72% of car buyers would drive 30-95 kilometers for a dealership with good reviews, and that all car buyers visit 4.2 websites during the customer journey (4, 5)?

So, do you have enough online reviews and user-generated content on your website to rank high enough to be in the 4.2 websites potential customers visit?

And then, do you have enough good reviews to convince them to drive to your dealership?

Your online reputation and your customer satisfaction automotive scores matter more with every passing year. Make sure to prioritise them now rather than later.

Sources:

- ACSI Press Release Automobiles in 2018

- V12. Automotive Marketing: An Overview of Current Marketing Trends, Statistics, and Strategies

- Think with Google: The Car Buying Process: One Consumer’s 900+ Digital Interactions

- V12 data. 54% of Consumers Would Buy from Dealerships Who Provide Better Experiences Compared to Lower Prices

- Cox Automotive Research and Market Intelligence: 2020 Cox Automotive Car Buyer Journey